The Ultimate Guide to AI-Driven Investing: How AI is Transforming Portfolio Management

Discover how AI-driven investing is revolutionizing portfolio management with machine learning, robo-advisors, and automated trading strategies.

Visit our partners at Trading View;

1. Introduction: Embracing a New Era of Investing

Welcome to the Ultimate Guide to AI-Driven Investing—a comprehensive resource that delves into how artificial intelligence is revolutionising portfolio management and reshaping investment strategies. In today’s fast-paced financial landscape, traditional wealth management approaches are giving way to innovative, algorithm-driven approaches that optimise asset allocation, manage risk, and deliver personalised recommendations. Whether you’re a curious novice or a seasoned finance professional, this guide will equip you with the knowledge and practical insights to leverage AI for smarter, more efficient investing in an increasingly complex market environment.

AI investing is more than a buzzword—it’s a transformative force that’s fundamentally changing how we approach investment decisions. By automating the analysis of vast datasets and continuously adapting to market trends, AI-driven investing empowers investors to make informed decisions with unprecedented speed and accuracy. This comprehensive guide explores the underlying technology, reviews leading robo-advisors, and provides actionable insights to help you navigate this evolving landscape, ensuring you stay ahead of the curve in the digital wealth management revolution.

Graphic 1: Image of AI-powered stock market visualization

2. Understanding AI-Driven Investing

What Is AI-Driven Investing?

AI-driven investing refers to the sophisticated use of machine learning in finance and advanced algorithms to manage investment portfolios with precision and efficiency. Unlike traditional methods that rely heavily on human intuition and periodic reviews, modern robo-advisors continuously analyse historical data, real-time market trends, and even alternative data sources to determine the most effective investment strategies. This automated process not only enhances decision-making speed but also significantly reduces the likelihood of human error, offering truly personalised portfolio management tailored to individual risk profiles and financial goals. The integration of artificial intelligence has revolutionised how we approach wealth management, making sophisticated investment strategies accessible to a broader audience.

Robo-advisors harness the power of AI to:

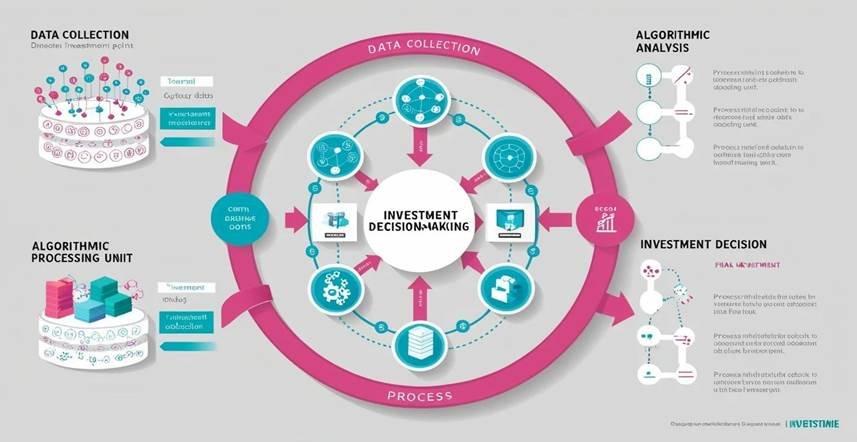

• Collect and Process Data: They aggregate and synthesise information from diverse sources—ranging from market data and economic indicators to social media sentiment and news analytics—to form a comprehensive foundation for analysis. This multi-dimensional approach ensures no valuable insight goes unnoticed.

• Analyse Trends: Advanced algorithms identify complex patterns, detect market anomalies, and forecast future market movements with remarkable accuracy. These systems continuously learn and adapt, improving their predictive capabilities over time.

• Automate Decisions: Based on the sophisticated insights generated, these platforms automatically adjust asset allocations and execute trades in real time, ensuring portfolios remain optimally balanced regardless of market conditions.

Graphic 2: Diagram illustrating the workflow of an AI algorithm—from data collection and processing to final investment decision-making.

Why AI-Driven Investing Matters

The integration of AI into investing processes offers several transformative benefits that are reshaping the financial landscape:

• Efficiency and Speed: AI algorithms have revolutionised the investment landscape by processing astronomical volumes of market data and executing trades with unprecedented speed and precision. These sophisticated systems can analyse millions of data points within milliseconds, identifying patterns and opportunities that human traders might overlook. Through AI-driven investing, portfolios are continuously monitored and optimised 24/7, ensuring that investment strategies remain responsive to real-time market dynamics and emerging trends.

• Personalization: Modern robo-advisors leverage advanced machine learning algorithms to deliver bespoke investment strategies that go beyond traditional risk profiling. These intelligent systems consider a comprehensive array of factors, including investment timeline, financial goals, income patterns, tax situations, and even life events, to craft truly personalised investment strategies. The AI continuously learns from investor behaviour and market responses, refining its recommendations to better align with individual preferences and circumstances over time.

• Enhanced Risk Management: AI-powered platforms employ sophisticated risk assessment models that operate on multiple levels simultaneously. These systems conduct real-time analysis of market conditions, geopolitical events, economic indicators, and sector-specific risks to provide comprehensive risk monitoring. Through predictive analytics and scenario modelling, potential risks are identified well before they materialise, allowing for proactive strategy adjustments. The AI’s ability to process alternative data sources, such as social media sentiment and news analytics, adds another layer of risk intelligence that traditional methods cannot match.

• Cost-Effectiveness: The automation inherent in AI-driven investing significantly reduces operational overheads traditionally associated with portfolio management. By minimising human intervention in routine tasks, these platforms can offer professional-grade investment services at a fraction of the cost of traditional wealth management services. The cost savings extend beyond just management fees—automated tax-loss harvesting, efficient rebalancing, and reduced transaction costs all contribute to better overall returns for investors.

The democratisation of sophisticated financial strategies through AI-driven investing represents a paradigm shift in wealth management. By making advanced investment techniques accessible to a broader audience, these platforms are levelling the playing field between institutional and retail investors. The combination of computational power, machine learning algorithms, and automated execution enables investors of all sizes to implement strategies that were previously available only to large institutional players. Moreover, the scalability of AI systems means that the quality of investment management doesn’t diminish with increased user numbers. Each investor receives the same level of sophisticated analysis and personalised attention, regardless of their portfolio size. This democratisation effect is particularly important in today’s rapidly evolving markets, where quick decision-making and efficient execution can significantly impact investment outcomes.

Graphic 3: Infographic comparing the benefits of traditional versus AI-driven investing.

3. Spotlight on Leading Robo-Advisors

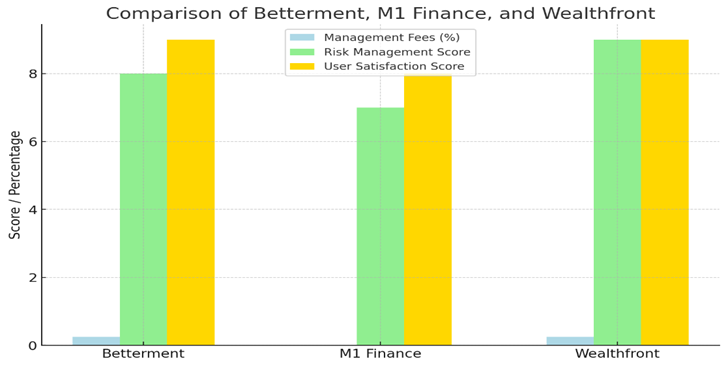

- Betterment stands as a pioneering force in the robo-advisory landscape, offering a sophisticated yet streamlined approach to investment management. Their platform excels in tax-efficiency optimisation through advanced algorithms that continuously monitor and adjust portfolios. The service implements automatic tax-loss harvesting and intelligent rebalancing, ensuring that investments remain optimised whilst minimising tax implications. Through AI-driven investing technologies, Betterment’s system analyses thousands of market scenarios to maintain optimal portfolio performance. Their competitive robo advisor fees and consistent robo advisor performance have made them a popular choice among investors seeking automated investment platforms.

- M1 Finance represents a revolutionary hybrid model that masterfully bridges the gap between automated efficiency and investor autonomy. Their unique “Pie” investing framework allows investors to maintain strategic control over their investment decisions while benefiting from cutting-edge automation. The platform’s intelligent rebalancing system ensures that portfolio allocations remain aligned with predetermined targets, whilst their dynamic cash management features optimise idle funds. This harmonious blend of control and automation makes M1 Finance particularly appealing to investors who wish to maintain active involvement in their investment strategy whilst leveraging the advantages of AI-driven technology. The platform’s approach to diversification and smart beta investing has garnered attention from both novice and experienced investors.

- Wealthfront distinguishes itself through its comprehensive suite of advanced financial planning tools and sophisticated asset allocation strategies. Their PathFinder technology utilises artificial intelligence to simulate thousands of potential financial scenarios, providing investors with detailed insights into their financial future. The platform’s dynamic asset allocation system continuously adapts to changing market conditions, implementing tax-sensitive rebalancing and risk parity strategies. Wealthfront’s advanced algorithms consider multiple factors, including tax implications, risk tolerance, and market conditions, to optimise portfolio performance across various market cycles. Their focus on automated financial planning and AI-powered portfolio management has positioned them as a leader in the robo-advisor space.

These cutting-edge platforms exemplify the transformative potential of ai driven investing, demonstrating how technological innovation can revolutionise traditional investment approaches. By combining sophisticated algorithms with user-friendly interfaces, these platforms have successfully democratised access to professional-grade investment strategies. Their success illustrates the growing acceptance and effectiveness of AI-powered investment solutions in modern portfolio management.

The impact of these platforms extends beyond mere automation; they represent a fundamental shift in how individual investors can access and manage their investments. Through continuous technological advancement and refinement of their algorithms, these platforms consistently enhance their ability to deliver personalised, efficient, and effective investment solutions.

Each platform offers unique advantages whilst maintaining core commitments to accessibility, efficiency, and sophisticated portfolio management. Betterment’s focus on tax efficiency, M1 Finance’s hybrid approach, and Wealthfront’s comprehensive planning tools collectively demonstrate the diverse ways in which AI technology can be applied to meet varying investor needs and preferences.

Moreover, these platforms continue to evolve, incorporating new technologies and features as they become available. Their commitment to innovation ensures that investors benefit from the latest advancements in financial technology and investment strategy. The integration of machine learning algorithms enables these platforms to become increasingly sophisticated in their analysis and decision-making processes, potentially leading to better investment outcomes for their users.

As the financial technology sector continues to advance, these platforms serve as prime examples of how ai driven investing can enhance investment strategies, making them more efficient, personalised, and accessible to a broader range of investors. Their success has paved the way for further innovation in the field, encouraging the development of even more sophisticated investment solutions that leverage artificial intelligence and machine learning technologies.

- Cost & Fees: Understanding how management fees affect net returns is essential for any investor considering ai driven investing platforms. Our comprehensive analysis meticulously compares fee structures across platforms, highlighting the most cost-effective options whilst considering the value proposition of each service. We examine both direct costs, such as management fees and transaction charges, and indirect expenses that might impact overall portfolio performance. This detailed evaluation enables investors to make well-informed decisions based on their investment objectives and budget constraints.

- Risk Management: We thoroughly evaluate how each platform leverages AI to mitigate risk through sophisticated algorithms and machine learning capabilities. Our assessment delves deep into the effectiveness of their rebalancing strategies, examining how these platforms respond to market volatility and economic uncertainties. The analysis encompasses their risk assessment techniques, including stress testing methodologies, diversification strategies, and dynamic portfolio adjustments. We particularly focus on how ai driven investing technologies adapt to changing market conditions whilst maintaining alignment with individual risk tolerances.

- User Experience: A user-friendly interface and robust customisation options are crucial elements in modern investment platforms. Our detailed comparison examines the ease of use, accessibility, and overall satisfaction among Betterment, M1 Finance, and Wealthfront users. We assess various aspects, including mobile functionality, dashboard intuitiveness, educational resources, and customer support quality. The analysis also considers the platforms’ ability to provide personalised insights and recommendations whilst maintaining simplicity in navigation and operation.

Graphic 4: Comparative chart showcasing key features, fee structures, and user ratings of Betterment, M1 Finance, and Wealthfront.

4. Hypothetical Case Studies and Success Scenarios

Whilst NextGenFinTools is a new resource, we can effectively illustrate the potential benefits of ai driven investing through carefully constructed hypothetical case studies. These detailed scenarios demonstrate how investors might experience enhanced outcomes across various investment objectives:

- Increased Returns: Our analysis demonstrates how automated rebalancing and dynamic asset allocation can lead to improved long-term performance. Through detailed examples, we illustrate how AI-driven strategies can identify opportunities and optimise portfolio composition for enhanced returns whilst maintaining appropriate risk levels.

- Improved Risk Management: We provide comprehensive illustrations of how AI algorithms adjust portfolios in response to market volatility, thereby reducing potential losses. These examples showcase the sophisticated risk management capabilities of modern robo-advisors and their ability to protect investor interests during various market conditions.

- Enhanced User Engagement: Our scenarios emphasise the significant value of interactive tools that enable users to compare and assess different robo-advisors in real time. We demonstrate how these features contribute to better decision-making and increased investor confidence.

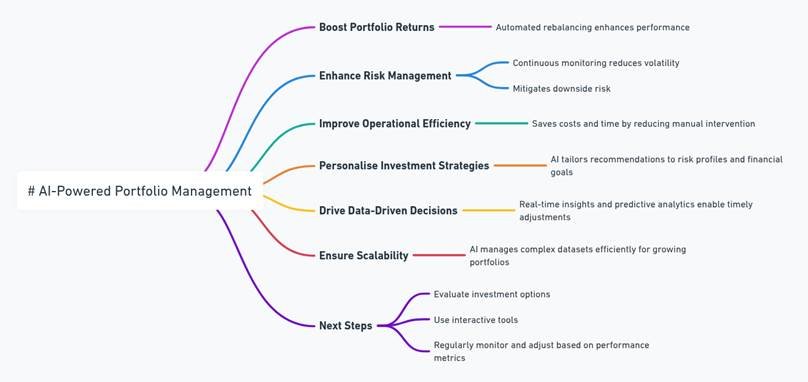

5. Actionable Insights and Next Steps

Our comprehensive guide concludes with practical, actionable insights designed to empower investors in their journey:

- Evaluating Your Investment Options: We provide a detailed, step-by-step checklist to help determine which robo-advisor best aligns with your specific financial goals and risk tolerance levels. This includes consideration of various factors such as investment horizon, tax situation, and desired level of portfolio customisation.

- Leveraging Interactive Tools: Comprehensive guidance on effectively utilising our custom-built comparison calculators and risk assessment tools to make well-informed investment decisions. These resources are designed to simplify complex comparisons whilst providing meaningful insights.

- Further Learning: Curated links to additional resources, upcoming webinars, and expert blogs for continuous learning and engagement in the evolving landscape of ai driven investing.

Graphic 5: Summary infographic that encapsulates the key takeaways and practical steps.

6. Conclusion

In conclusion, the landscape of AI-driven investing is rapidly evolving, with robo-advisors at the forefront of this transformation. By offering low-cost investing options, real-time monitoring, and automated rebalancing, these platforms are reshaping the way individuals approach wealth management. As the technology continues to mature, we can anticipate even more sophisticated applications of AI in portfolio optimization and personalized investment strategies, further democratizing access to advanced financial tools and potentially improving investment outcomes for a wide range of investors.

Our thorough comparative analysis, carefully constructed hypothetical case studies, and practical, actionable insights have been strategically designed to equip you with the essential knowledge needed to critically evaluate your investment options and effectively leverage our suite of interactive tools for enhanced decision-making. At NextGenFinTools, our unwavering commitment remains focused on empowering investors like you with comprehensive knowledge and sophisticated resources, enabling you to confidently navigate the intricacies of ai driven investing whilst working towards achieving superior financial outcomes in your investment journey.

We encourage you to take the next step in your investment journey by exploring our extensive collection of interactive tools, designed specifically to simplify complex investment decisions.

Visit our partners at Trading View; Amazon

Subscribe to our weekly newsletter for exclusive insights, market updates, and expert analysis of emerging trends in AI-driven investing.

Download our comprehensive actionable checklist, meticulously crafted to guide you through the essential steps of initiating your journey into ai driven investing. This valuable resource includes detailed evaluation criteria, platform comparison frameworks, and practical implementation strategies to ensure a smooth transition into the world of automated investment management.

Why not try – Amazon